Binance is one of the world’s largest and most popular cryptocurrency exchanges, offering a comprehensive platform for trading a wide variety of digital assets. Understanding how Binance trading works can empower both beginners and experienced traders to navigate the volatile crypto market effectively. At its core, Binance provides users with the ability to buy, sell, and exchange cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), Binance Coin (BNB), and many others through various order types and trading pairs.

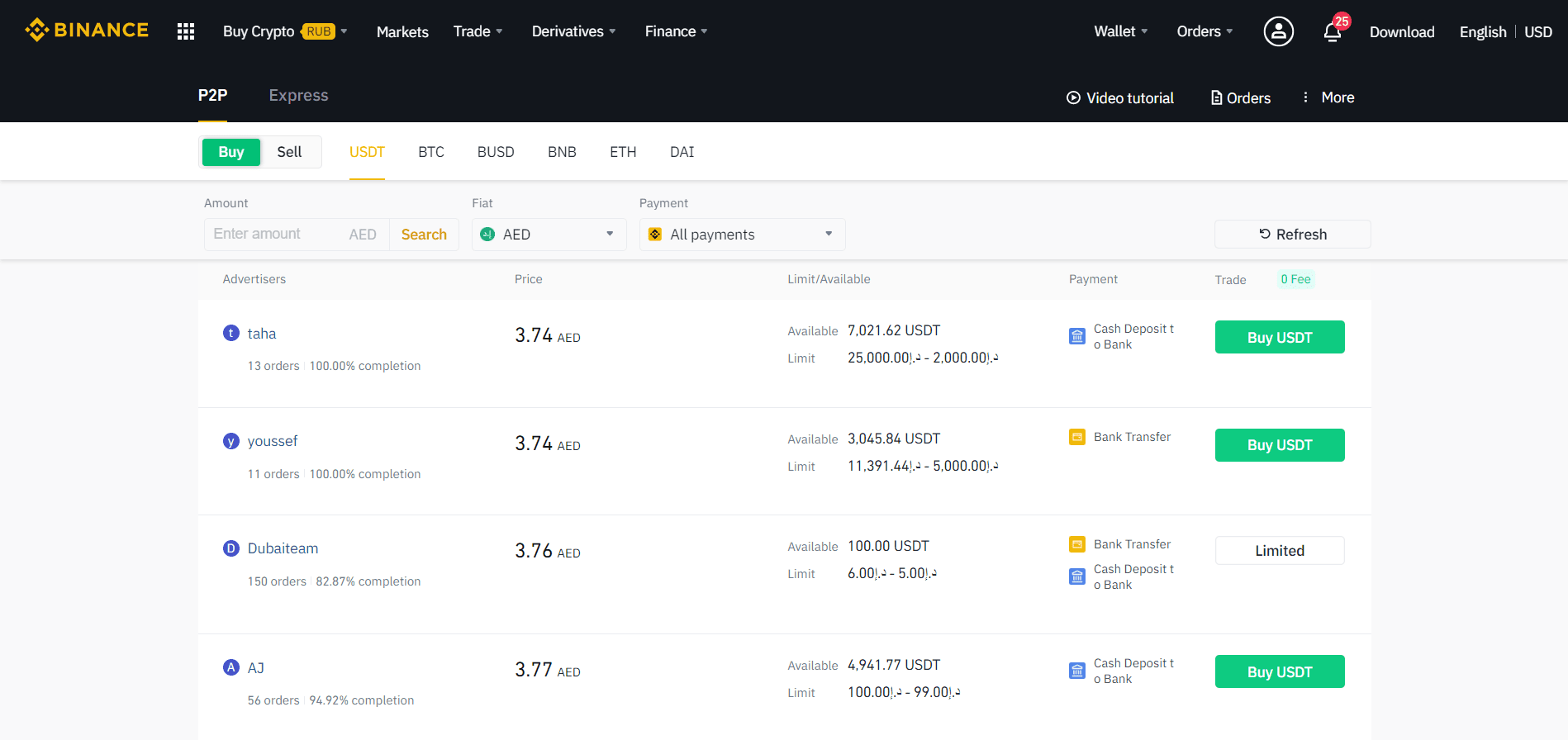

When you start trading on Binance, you first need to create an account and complete identity verification processes as required by regulatory standards. After funding your account via bank transfer, credit card, or depositing cryptocurrencies from another wallet, you can access the spot market where most straightforward trades occur. The spot market allows immediate buying or selling of assets at current prices.

One common example is purchasing Bitcoin using USDT (Tether). Suppose BTC/USDT is currently priced at $30,000 per Bitcoin. If you want to buy 0.1 BTC immediately at how this works in practice price, placing a “market order” will execute your trade instantly at the best available rate. Conversely, if you believe BTC’s price will drop before rising again, you might place a “limit order” set below $30,000-say $29,500-which only executes if the market reaches that level.

Binance also offers advanced features such as margin trading where users borrow funds to increase their buying power but must be cautious due to higher risks involved with leverage. For example, if you apply 5x leverage when buying ETH worth $1,000 using borrowed funds plus your margin capital of $200; any gain or loss amplifies five times accordingly.

Additionally, futures trading on Binance allows speculation on asset prices without owning them directly by entering contracts based on expected future values. For instance, if a trader believes that BTC will rise in value over the next month from its current price of $30K to above $35K they may open a long futures position anticipating profit from this movement without needing full capital upfront.

Real-life examples illustrate these concepts clearly: In early 2021 during bullish trends in cryptocurrency markets many traders used limit orders on Binance to accumulate altcoins like Cardano (ADA) when prices dipped temporarily before surging later-maximizing returns efficiently rather than chasing high prices impulsively.

In summary,Binance provides versatile tools suitable for different strategies-from simple spot buys/sells via market or limit orders to complex leveraged positions in margin or futures markets-making it accessible yet powerful for anyone interested in cryptocurrency trading. Proper understanding combined with disciplined risk management remains key for success within this dynamic ecosystem offered by Binance’s platform.